Serving 100,000+ customers nationwide, OneUnited is an award-winning CDFI committed to closing the wealth gap through financial literacy and accessible banking.

Client Overview

With branches in Boston, Los Angeles, and Miami—and a rapidly growing digital footprint—OneUnited has long been a pioneer in purpose-driven, technology-forward banking. Its first digital banking service launched in 2005, and today the bank serves most of its customers through its mobile app and online channels, demonstrating how mission-led banking thrives when paired with innovation.

The Opportunity

As a digital-first institution, OneUnited faced a new competitive landscape—not just other community banks, but fintech challengers and financial apps attracting consumers with sleek, intuitive experiences.

To strengthen its position and deepen customer impact, OneUnited envisioned a mobile app that could serve as a true financial wellness companion—one that delivers personalized insights, credit-building tools, and educational resources to help customers save, grow, and thrive financially.

Key Benefits at a Glance

Omni-channel by Design:

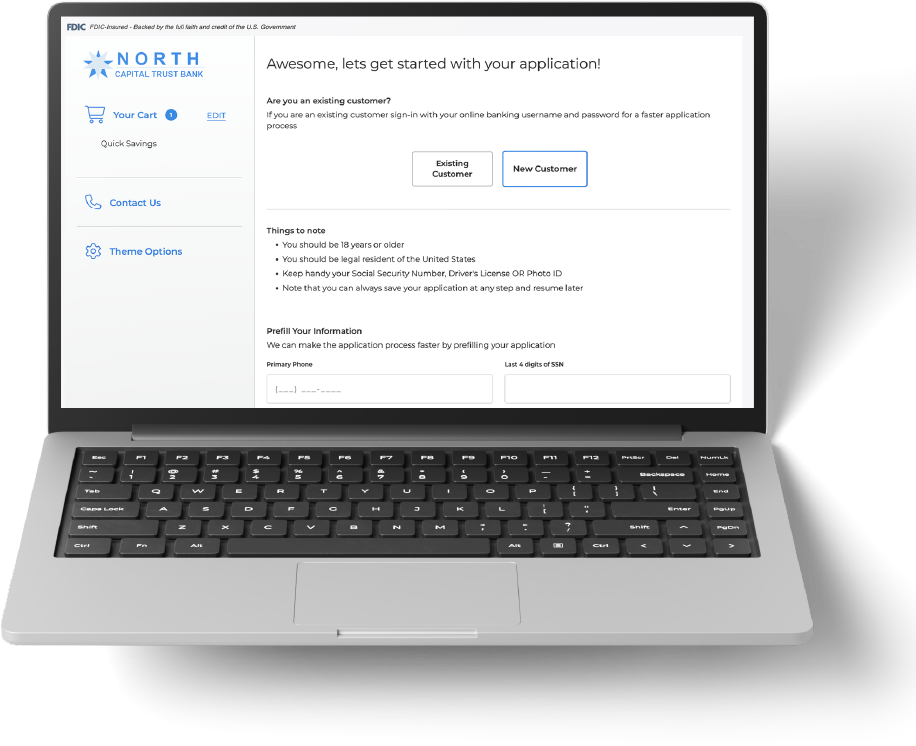

One platform across digital, branch, and call center for seamless onboarding

Fast, Cost-Efficient Deployment:

Go live in weeks at up to 60% lower implementation cost than legacy vendors

Modern UX that Converts:

Mobile-first design reduces abandonment and drives higher completion rates

Proven ROI:

192%-225% digital deposit growth and 75% faster branch account openings

The Solution

- Customize digital banking experiences with hundreds of integrated features.

- Personalize interactions using data-driven insights.

- Scale operations seamlessly as customer demand grows.

- Integrate third-party fintech solutions quickly and effectively.

Customize digital banking experiences with hundreds of integrated features.

Scale operations seamlessly as customer demand grows.

Improve customer experience and drive higher conversion rates.

Integrate third-party fintech solutions quickly and effectively.

The Impact

Achieved a 33% increase in adoption of digital banking feature

Accelerated the delivery of new capabilities and product updates

Improved app usability, delivering a more seamless, intuitive user experience