Serving 100,000+ customers nationwide, OneUnited is an award-winning CDFI committed to closing the wealth gap through financial literacy and accessible banking.

Client Overview

As member behavior increasingly shifted to mobile and online channels, Horizon recognized that sustaining its competitive edge required a modern, intuitive digital experience—one that matched the ease and polish of national banks while preserving the trust and consistency members expect from a credit union.

The Opportunity

Like many mid-sized credit unions, Horizon faced rising expectations shaped by fintechs and large financial institutions offering sleek, consumer-grade digital experiences. Horizon wanted to modernize its digital banking interface, surface underutilized features, and introduce greater personalization—without disrupting operations or overwhelming its member support teams.

Key Benefits at a Glance

Omni-channel by Design:

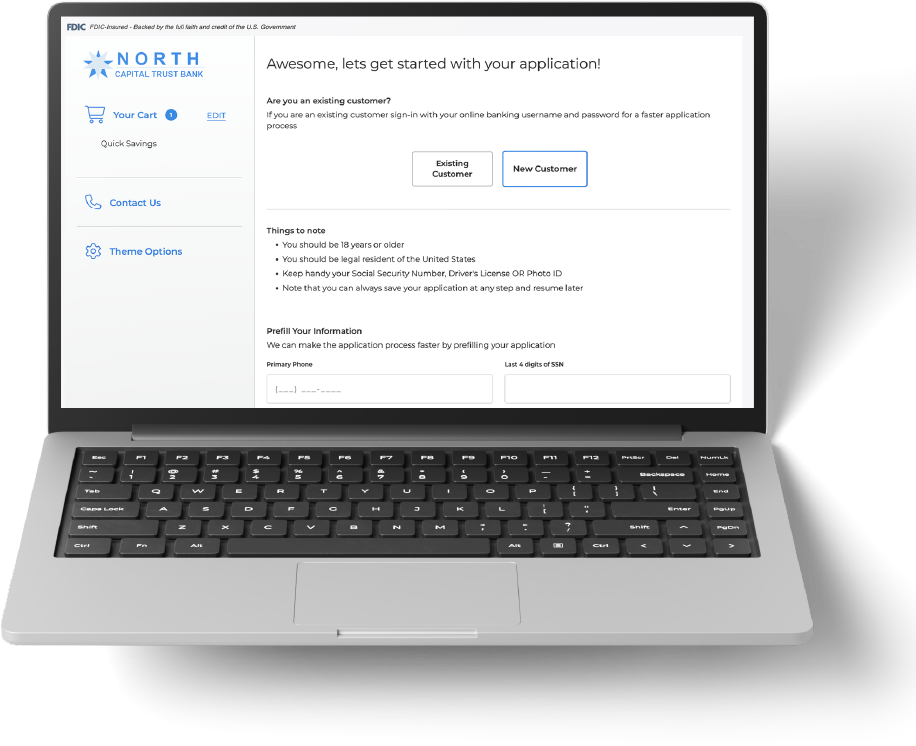

One platform across digital, branch, and call center for seamless onboarding

Fast, Cost-Efficient Deployment:

Go live in weeks at up to 60% lower implementation cost than legacy vendors

Modern UX that Converts:

Mobile-first design reduces abandonment and drives higher completion rates

Proven ROI:

192%-225% digital deposit growth and 75% faster branch account openings

The Solution

The result was a cleaner, more intuitive, and more consistent experience across web and mobile. Members now benefit from a modern, task-focused design and customizable widgets, while Horizon retains the flexibility to configure and evolve the experience behind the scenes. For internal teams, the platform enables non-disruptive upgrades, seamless third-party integrations, and ongoing operational support.

Customize digital banking experiences with hundreds of integrated features.

Scale operations seamlessly as customer demand grows.

Improve customer experience and drive higher conversion rates.

Integrate third-party fintech solutions quickly and effectively.

The Impact

Scalability for expansion

which required automation of operational tasks including application analysis, document archiving and automation of data to monitoring systems.

Extensible integrations

with 110+ APIs, enabling configurability, compliance and business process improvement, doubling throughput without increasing resources.

Built-in fraud detection

powered by Candescent’s ecosystem to identify risk earlier without slowing legitimate applicants down.

The Impact

Following its full rollout in August 2025, Horizon experienced a smooth launch with minimal member confusion and strong early adoption—validating its approach to modernization. Early usability studies and member feedback point to meaningful improvements in engagement, efficiency, and brand perception.

By leveraging Candescent’s NextGen UI/UX and extensible platform, Horizon Credit Union demonstrates how mid-sized institutions can deliver digital experiences that rival national banks—without sacrificing the personalized, community-first service that defines their brand.